Why I Give

“Scholarships can be the difference between succeeding and giving up,” said Anthony Law.

Law, Carl Sandburg College coordinator of diversity and inclusion, was born in Galesburg and earned his bachelor’s degree with a double major in criminal justice and psychology.

His mother, Naomi Law, served as a long-time administrator for the Joliet School District.

“I was driven as a kid because I saw the outcome of education from my mother. I have aunts and uncles that hold their doctorate degrees,” said Law.

Prior to coming to Sandburg, Law worked at Illinois State University, Scott Community College and Palmer College of Chiropractic. Law, the founder of Men of Distinction and Women of Character, is approaching 12 years of employment at the College. The community-service oriented MOD and WOC are student organizations that help students strengthen their bond with others while increasing cultural awareness both academically and socially on Carl Sandburg College’s campus and throughout the community. Men of Distinction and Women of Character will celebrate their tenth anniversary in 2024.

In his role, Law has the opportunity to work with students from when they arrive to when they graduate. It is his passion to have daily interactions with the students and provide support.

“I’ve been in higher education for 30 years. The journey is not always easy for students. Sometimes it is the $100-500 scholarships that make a difference,” said Law.

Last year Law established the 569 Community Service Scholarship in honor of Rosella Peters, Naomi Brown, and Lillian Jackson. Known as “The Three Sisters from 569 West First Street.” Peters, Brow and Jackson were known throughout their community for service at local hospitals, nursing homes and churches. “The Three Sisters” also served as the foundation and inspiration for Women of Character.

The scholarship supports students who are active members of Sandburg’s Black Student Association, Hispanic Latino Student Association, Men of Distinction or Women of Character.

Law said, “Scholarships reflect the blessing I want to share to help someone."

Pay It Forward by Carol Rogers

"When I was going to college, I was not aware of scholarships and only took a few classes at a time to save on the costs," Carol Rogers said. "I learned all about the Sandburg Foundation's work and wanted to support their mission."

Born in Andover, Illinois, Rogers was interested in nursing or becoming a teacher when she attended elementary school.

"I knew higher education was key to life success," said Rogers.

After graduating from Orion High School, Rogers worked in a plastics factory and held various additional jobs. When she was 21 years old, her friend asked why she was not attending college.

"I told my friend that I didn't have the money and he gave me money to enroll in college," Rogers said.

She earned her associate's degree and today works as the benefits manager in the Carl Sandburg College Human Resources department.

Rogers had known her future husband, Tom, for most of her life before they wed in 2010. He attended Western Illinois University and graduated from St. Ambrose University. Tom worked at Gale Products, managed I & I Tools in Galesburg and worked various jobs in the Quad Cities area.

"Tom always loved working on cars. He wanted younger people to understand the value of older cars," said Rogers.

When Tom passed in November of 2022, Rogers decided to honor Tom's memory by establishing a scholarship in his name.

The "Tom" Robert Rogers Scholarship encourages students to learn the skills needed to keep the interest and history of cars going for generations to come. Students pursuing the automotive program are given preference; however, all areas of study are considered if there is a passion for classic cars.

"Growing up I always read Dr. Percy Ross' Thanks a Million newspaper column, where he would grant financial requests for readers. I wanted to be a philanthropist like Dr. Ross," Rogers said.

While Rogers and her husband never discussed creating a college scholarship, she knows he would be pleased by her decision.

"Tom was very giving and I am sure he would wish to pay it forward," said Rogers.

The gift of education is one of the greatest gifts you can make. Scholarships through the Carl Sandburg College Foundation are made possible by the generosity of our alumni, friends, area businesses, faculty and staff. The Sandburg Foundation offers two ways that you can support students through scholarships:

Annual Scholarships

Annual scholarships reflect a donor's commitment to support a scholarship for a specific number of years. An annual scholarship is a great way to honor a loved one, promote your business, or give back to the students of Carl Sandburg College. Annual scholarships can be adjusted on an annual basis offering flexibility to the donor. Gifts made to annual scholarships are not invested, and do not earn additional income. Scholarship amounts range with the total split between fall and spring semester.

Endowed Scholarships

Establishing a named endowed scholarship provides a permanent and personal way for you to make a difference. An immediate gift or pledge of $10,000 is invested and 25% of the net interest is used, leaving the principal intact. An endowed scholarship becomes a permanently endowed fund when the contribution reaches a minimum of $10,000 and can be pledged over a number of years. The scholarship amount is based on the interest earned and accumulated each year. As your endowment grows, the more scholarship dollars it will produce.

Benefits of Becoming a Donor

- A working relationship with the Foundation to establish award guidelines from which to select and award scholarships.

- Involvement in determining the scholarship criteria to reflect a special area of interest, academic discipline, geographic region, academic merit, or financial need.

- An invitation to attend our annual scholarship reception with a chance for donors to meet their scholarship recipient(s) and receive thanks.

- Profound satisfaction of knowing your generosity has made a lasting impact in the lives of students.

Ready to Become a Sandburg Donor?

The Carl Sandburg College Foundation has an exceptional group of donors who are dedicated to making a direct impact on students' lives through the gift of education.

For more information about establishing annual and endowed scholarships, please contact the Sandburg Foundation at 309.341.5349 or foundation@sandburg.edu.

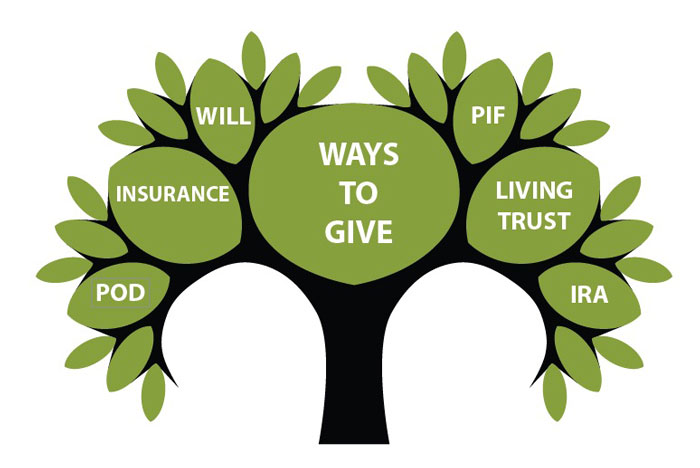

What to give

Donating appreciated securities, including stocks and bonds, is an easy and tax-effective way to make a gift to Carl Sandburg College.

Benefits of gifts of stocks and bonds

- Avoid paying capital gains tax on the sale of appreciated stock.

- Receive a charitable income tax deduction.

- Further our mission today.

Donating appreciated real estates, such as a home, vacation property, undeveloped land, farmland, ranch or commercial property, can make a great gift to Carl Sandburg College.

Benefits of gifts of real estate

- Avoid paying capital gains tax on the sale of the real estate.

- Receive a charitable income tax deduction based on the value of your gift.

- Leave a lasting legacy to Carl Sandburg College.

Donating part or all of your unused retirement assets, such as a gift from your IRA, 401(k), 403(b), pension or other tax-deferred plan, is an excellent way to make a gift to Carl Sandburg College.

Benefits of gifts of retirement assets

- Avoid paying potential estate tax on retirement assets.

- Your heirs would avoid income tax on any retirement assets funded on a pre-tax basis.

- Receive potential estate tax savings from an estate tax deduction.

A gift of your insurance policy is an excellent way to make a gift to charity. If you have a life insurance policy that has outlasted its original purpose, consider making a gift of your insurance policy.

Benefits of gifts of insurance

- Receive a charitable income tax deduction.

- If Carl Sandburg College cashes in the policy, you'll be able to see firsthand how your gift supports our institution.

- If we retain the policy to maturity, or you name us as a beneficiary, once the policy matures, the proceeds of your policy will be paid to Carl Sandburg College so we can use the proceeds to further our mission of providing everyone the opportunity of education.

A gift of cash is a simple and easy way for you to make a gift.

Benefits of gifts of cash

- Make an immediate impact on our mission.

- Benefit from a charitable income tax deduction.

How to give

Designating Carl Sandburg College as the beneficiary of your asset by will, trust or beneficiary designation form is one of the easiest gifts to make. With the help of an attorney, you can include language in your will or trust specifying a gift to be made to family, friends or Carl Sandburg College as part of your estate plan, or you can make a bequest using a beneficiary designation form.

Benefits of a bequest

- Receive an estate tax charitable deduction.

- Reduce the burden of taxes on your family.

- Leave a lasting legacy to charity.

Here are some of the ways to leave a bequest to Carl Sandburg College

- Include a bequest to Carl Sandburg College in your will or revocable trust.

- Designate Carl Sandburg College as a full, partial or contingent beneficiary of your retirement account (IRA, 401(k), 403(b) or pension).

- Name Carl Sandburg College as a beneficiary of your life insurance policy.

A bequest may be made in several ways

- Percentage bequest: Make a gift of a percentage of your estate.

- Specific bequest: Make a gift of a specific dollar amount or a specific asset.

- Residual bequest: Make a gift from the balance or residue of your estate.

Congress has enacted a permanent IRA charitable rollover. As a result, you can make an IRA rollover gift this year and in future years. If you are 70.5 years or older, you may be interested in a way to lower the income and taxes from your IRA withdrawals. An IRA charitable rollover is a way you can help continue our work and benefit this year.

Benefits of an IRA charitable rollover

- Avoid taxes on transfers of up to $100,000 from your IRA to Carl Sandburg College.

- Satisfy your required minimum distribution for the year.

- Reduce your taxable income, even if you do not itemize deductions.

- Make a gift that is not subject to the 50% deduction limits on charitable gifts.

- Help further the mission of Carl Sandburg College.

How an IRA charitable rollover gift works

- Contact your IRA plan administrator to make a gift from your IRA to Carl Sandburg College.

- Your IRA funds will be directly transferred to our organization to help continue our educational mission.

- IRA charitable rollover gifts do not qualify for a charitable deduction.

- Please contact our office if you wish for your gift to be used for a specific purpose by calling 309.341.5349.

A beneficiary designation gift is a simple and affordable way to make a gift to support Carl Sandburg College. You can designate us as a beneficiary of a retirement, investment or bank account, or your life insurance policy.

Benefits of a beneficiary designation gift

- Support Carl Sandburg College.

- Continue to use your account as long as you need to.

- Simplify your planning and avoid expensive legal fees.

- Reduce the burden of taxes on your family.

- Receive an estate tax charitable deduction.

How a charitable gift annuity works

- You make your gift, contact your financial advisor, broker, insurance agent or banker.

- Ask them to send you a new beneficiary designation form.

- Complete the form, sign it, and mail it back to the appropriate person.

- When you pass away, your account or insurance policy will be paid or transferred to Carl Sandburg College, consistent with the beneficiary designation.

If you are interested in making a gift but are also concerned about your future needs, keep in mind that beneficiary designation gifts are about the most flexible of all charitable gifts. Even after you complete the beneficiary designation form, you can take distributions or withdrawals from your retirement, investment or bank account and continue to freely use your account. You can also change your mind at any time in the future for any reason, including if you have a loved one who needs your financial help.

You transfer your cash or appreciated property to our organization in exchange for our promise to pay you fixed payments (with rates based on your age) for the rest of your life.

Benefits of a charitable gift annuity

- Receive fixed payments to you or another annuitant you designate for life.

- Receive a charitable income tax deduction for the charitable gift portion of the annuity.

- Benefit from payments that may be partially tax-free.

- Further the mission of Carl Sandburg College with your gift.

How a charitable gift annuity works

- You transfer cash or property to Carl Sandburg College.

- In exchange, we promise to pay fixed payments to you for life. The payment can be quite high depending on your age, and a portion of each payment may even be tax-free.

- You will receive a charitable income tax deduction for the gift portion of the annuity.

- You also receive satisfaction, knowing you will be helping further our mission.

If you decide to fund your gift annuity with cash, a significant portion of the annuity payment will be tax-free. You may also make a gift of appreciated securities to fund a gift annuity and avoid a portion of the capital gains tax. Please contact us or your attorney to inquire about other assets you might be able to use to fund a charitable gift annuity.

You can transfer your cash or appreciated property to fund a charitable remainder unitrust. The trust sells your property tax-free and provides you with income for life or a term of years.

Benefits of a charitable remainder unitrust

- Receive income for life, for a term of up to 20 years, or life plus a term of up to 20 years.

- Avoid capital gains on the sale of your appreciated assets.

- Receive an immediate charitable income tax deduction for the charitable portion of the trust.

- Establish a future legacy gift to Carl Sandburg College.

How a charitable remainder unitrust works

- You transfer cash or assets to fund a charitable remainder trust.

- In the case of a trust funded with appreciated assets, the trust will then sell the assets tax-free.

- The trust is invested to pay income to you or any other trust beneficiaries you select based on a life, lives, a term of up to 20 years, or a life plus a term of up to 20 years.

- You receive an income tax deduction in the year you transfer assets to the trust.

- Carl Sandburg College benefits from what remains in the trust after all of the trust payments have been paid.

You fund a trust that makes gifts to Carl Sandburg College for a number of years. Your family receives the trust remainder at substantial tax savings.

Benefits of a charitable lead trust

- Receive a gift or estate tax charitable deduction.

- Pass inheritance on to family at a reduced or zero cost.

- Establish a vehicle from which you can make annual gifts to charity.

How a charitable lead trust works

- You make a contribution of your property to fund a trust that pays Carl Sandburg College income for a number of years.

- You receive the gift of estate tax deduction at the time of your gift.

- After a period of time, your family receives the trust assets plus any additional growth in value.

Benefits of a life estate reserved gift

- Receive a federal income tax deduction for the value of the remainder interest in your home or farm.

- Preserve your lifetime use and control of your home or farm.

- Create a life estate based on more than one life. This will preserve the use of the property for you and a loved one, such as a spouse or dependent child.

How a life estate gift works

- You deed your home or farm to Carl Sandburg College. The deed will include a provision that gives you the right to use your home or farm for the rest of your life and that of any other life estate party named in the deed.

- You and Carl Sandburg College sign a maintenance, insurance and taxes (MIT) agreement to explain you will do your best to keep the property in good condition and that you will maintain property insurance and pay the property taxes.

- When the owners of the life estate have passed away, your home or farm will belong to Carl Sandburg College. We will use or sell the property to further our educational mission.

Please note: The life estate can last for your life or based on your life and that of another person, such as a spouse or loved one. It is possible for you to make a gift of your property even though there is a mortgage upon the residence. You will be responsible for the maintenance, insurance, and taxes on the property, just as you were prior to creating the life estate gift. If at some point in the future, you are no longer able to live independently in your home, we may be able to help you use your life estate to create a lump-sum cash payment (with joint sale) or create an income stream (using the life estate to fund a charitable remainder trust or charitable gift annuity).